European poultry meat production is expected to end this year higher, and the growth in output is expected to continue into next year, albeit at a slightly lower rate.

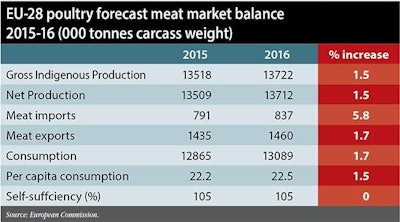

While the rate of expansion will be below the 2014 high, the European Commission forecasts that the 28-member bloc could see gross indigenous production (GIP) expand by 240,000 tons this year to reach 13.5 million tons, a 1.8 percent increase, while production is expected to grow by 1.5 percent next year.

Despite not being immune to outbreaks of avian influenza and remaining shut out of the Russian market, European poultry production has, nevertheless, seen a number of factors work to its benefit, and built on the strong growth experienced in 2014. The sector has enjoyed low feed prices and benefited from the disease difficulties experienced in the U.S. and its consequent loss of overseas trade.

2014 saw output expand by 4 percent and sharp increases in prices. 2015, however, has witnessed more subdued expansion and price stability. Nevertheless, the industry experienced a strong start to the year, with total European Union (EU) broiler meat production expanding by 4 percent. Particularly strong growth was recorded in Poland and Spain.

Improving trade balance

The EU’s poultry meat exports expanded by 5 percent during the first four months of this year, with higher sales to Asia and Africa more than making up for lost sales to Russia. By year-end, the Commission forecasts, European poultry meat exports could be 6.4 percent higher, compared with 2014.

For 2016, growth in Europe’s exports of poultry meat is expected to slow to 1.8 percent but, nevertheless, this will be a third successive year of expansion after 2013’s 1 percent contraction.

While exports have been rising, imports have been declining.

Europe’s poultry meat imports over the first four months of this year were 8 percent lower, with the contraction in chicken meat sourced from Brazil being particularly notable, down by 20 percent over the period.

Imports from Thailand, however, were higher when compared with the same period last year. The return of Thai chicken to the European market could mean that the strong contraction in overall imports is diluted by year-end, and the Commission forecasts that total poultry meat imports for 2015, will be only 3 percent lower.

This situation, however, is not expected to last and, for 2016, the Commission believes that the European Union will import almost 6 percent more chicken meat than in 2015.

Per capita consumption

Per capita poultry meat consumption in the EU is expected to grow by 1 percent this year. Per capita consumption has been rising year on year since at least 2011, and this year is expected to stand at 22.2 kg. For 2016, this figure is expected to rise 22.5 percent.

Poultry, as a share of total meat consumption, has been relatively stable over the past few years. The forecast for 2015 sees a very small contraction, to 29.9 percent, compared with 30 percent last year. Next year, this figure is expected to rise to 30.2 percent.

Total poultry meat consumption in the European Union is forecast to reach 12.9 million tons this year, rising to 13.1 million next year.

The European Union’s self sufficiency in poultry meat will rise to 105 percent this year, up from 104 percent last year, and stay at this level during 2014.

To learn more, read:

What’s happening in the European poultry industry?