Even with a crushing load of negative news, consumer confidence at an all-time low, credit failures, bank closures, auto bailouts, bankruptcies, a falling stock market and more, the industry continues to remain optimistic about the future. Perceptions of current conditions, however, were more dismal and in sync with all these caustic realities.

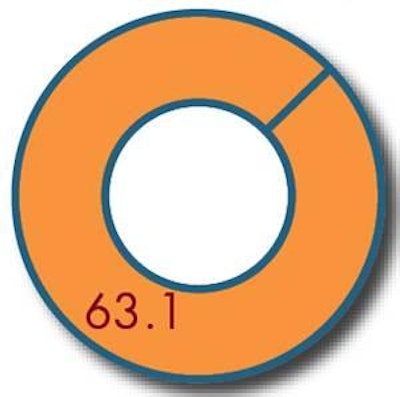

The WATT/Rennier Poultry Confidence Index now stands at 63.1 (1996 baseline=100), up from 45.5 the previous quarter. The Present Situation Index held "statistically steady" at 13.5 (versus 10.6). The Expectations Index increased to 96.2 from 68.9.

Although the picture was not all rosy, the rise in expectations was encouraging. Two forward-looking sub-indices—Future Conditions and Future Profits—outperformed the baseline (106.9 and 122.1 respectively).

This budding optimism in the poultry market was contrasted by a much gloomier consumer market. The Consumer Confidence Index was at an all-time low in October.

The poultry industry focused on the positives, even though the negatives were powerful. As usual, supply, demand and input costs had the most influence over one's outlook.

Many felt that demand would increase over the near term due to seasonality and lessened competition, while recent cuts in egg sets and placements were nearly universally praised. At the time of writing, recent week-to-week egg sets were down 3% to 5% over a year ago. Unfortunately, this production restraint had not yet influenced prices which were holding steady, declining slightly or—in the case of leg quarters—rapidly falling.

Recent price reductions in the propane, energy and grain segments further fueled the industry's optimistic outlook.

There were several warnings to balance against the positive comments. Some felt that input prices could go up again as quickly as they have recently fallen. Also, others advocated for even larger production cuts, or feared that integrators would reverse course (as has often been the case in the past). For some, the best they could foresee was, "It may not be profitable in six months, but the losses should be much less."

Confidence Summary. Present conditions remain weak, but the industry remains remarkably resilient. If integrators can stick to their aggressive production cuts and cost-cutting measures and the grain and energy markets remain stable then the next six months could bring a reason to smile.

Presidential Election. During the third quarter of this year, we asked, "If the presidential election were held today, for whom would you vote?" Nearly 80% of respondents said "John McCain" while 15% said "Barack Obama." We can only hope that President Obama will be a friend to agriculture in general and specifically poultry. Reducing preferences for corn-based ethanol would be a step in the right direction.