The results of an exclusive survey into the chicken buying and consumption habits of the Chinese public were revealed at the International Poultry Forum China in September 2014. The China Consumer Chicken Market Survey, thought to the first of its kind carried out in China, was commissioned by Poultry International China Edition, and sponsored by the China Broiler Alliance, and reveals purchasing habits of more than 1,700 respondents across various age groups.

In the preface to the survey’s findings, its authors note that several food safety and quality issues have emerged in China’s food industry over recent years, including in the poultry industry, and a significant contributor to these problems has been poor communication.

In today’s economic environment, information is a valuable resource and has become as important as capital and land. Information is now key, and when important information is not shared, there can be serious repercussions, the authors note.

This failure to communicate and share information is not peculiar to developing countries such as China, which has operated a market economy for only some 30 years, but also occurs in more developed countries, which have operated market economies for centuries.

Room for improvement

China has sufficient volumes of chicken to satisfy consumer demand, however its quality, safety and the sustainability of its production could all be improved. And while the chicken consumption patterns of Chinese consumers are changing, consumers’ views are rarely taken into account.

Avian influenza H7N9 returned to China in May 2014 and, in response, some large and medium cities in China banned the sale of live birds. At consumer level, there was a change in demand for freshly slaughtered poultry.

Chilled, fresh chicken is now available in Shanghai, Guangzhou and some other cities. The supply chain, however, still needs refinement and, consequently, product quality can be uneven. Unsurprisingly, consumption patterns are similarly uneven.

More information needed

The reality in China is that information sharing and communication between chicken producers, chicken processors and the country’s final consumers has been poor for many years. Chicken producers and retailers are well informed, but consumers have little information about the quality of produce they buy.

This has affected demand in two ways. First, chicken products do not sell as well as they could as consumers do not really know what they are buying. Second, because so little information is available to purchasers, they may unwittingly buy inferior product and then be disappointed upon discovering quality issues.

This withholding of information led to China’s recent food safety incidents, which eventually fed through into financial issues for the country’s chicken production and marketing companies.

It is also worth emphasizing that, in China, even with the recent food safety and quality incidents, the real concerns of consumers are rarely reported, the authors say.

So what did the survey find?

Meat preference

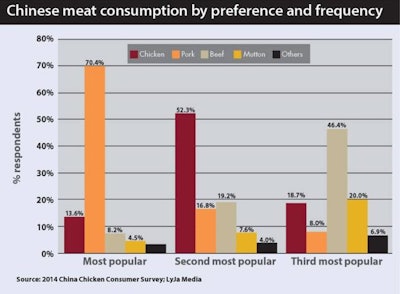

The China Consumer Chicken Market Survey found that chicken was the second most popular of all meats eaten in China. On a daily basis, pork is still the most popular meat, followed by chicken in second place, beef in third, then mutton, fish, and “others.”

Of the 1,716 respondents, 13.6 percent said chicken was their meat of choice, while 53.6 percent said it was their meat of second choice.

The survey also looked at frequency of chicken consumption. When asked how many times they had consumed chicken over a two-week period, 61.6 percent of respondents answered 1-3 times, 17.6 percent responded 4-6 times, 14.1 percent said they had not eaten chicken at all over the period, while 6.8 percent replied that they had eaten chicken more than six times.

The survey revealed that, among respondents ages 36-45 and 46-55, chicken consumption of 1-3 times over the period stood at 65.5 percent and 64.9 percent, respectively – higher than for any other age group. Among respondents aged 18-25, 21 percent noted that they had eaten chicken 4-6 times over the two-week period - higher than any other age group.

Consumption channels

The most popular point of purchase remains traditional markets. The point of purchase for 74.6 percent was a market, 36.7 percent selected supermarket, while 0.3 percent said via a “network." 14.4 percent selected “various channels.”

More than any others, the age groups that bought more chicken in markets and less in supermarkets were 26-45-year-olds, and 46-55-year-olds.

Type of purchase

More than two-thirds of respondents favored freshly prepared chicken, while one-quarter opted for chilled fresh chicken.

Freshly prepared chicken was purchased by 67.7 percent of respondents, while 25.3 percent responded that they often bought chilled fresh chicken, 20.8 percent bought frozen chicken, and 12.9 percent bought chicken in a variety of presentations.

The survey also revealed that the higher the age of the respondent, the stronger the habit of buying freshly prepared chicken.

Across age groups, a preference emerged for buying chilled fresh chicken rather than frozen chicken. Those ages 18-25 and 26-35 were more likely to buy fresh chilled chicken than any other age group.