The U.S. Department of Agriculture (USDA) estimates that, in September 2015, the U.S. had 23.6 million hens housed cage free, a 37 percent increase from the agency’s September 2014 estimate. Pledges to purchase eggs from cage-free layers by major restaurant chains and food companies are driving this increase.

Industry sources expect the U.S. cage-free layer flock to continue to grow at a rapid rate. Among the many projects underway, the three largest egg producers in the U.S. are designing and building cage-free farms that will become the largest cage-free egg facilities in North America.

Cage-free laying flock increasing

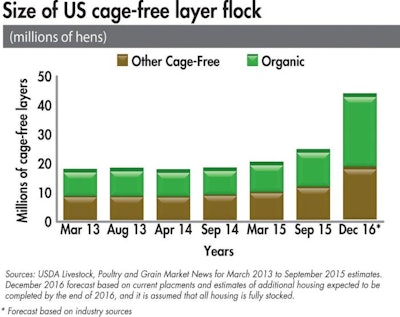

USDA estimates for the size of the cage-free layer flock in the U.S., for organic and non-organic egg production, are published on a semi-annual basis (see Figure 1). From March 2013 through March 2015, the size of organic and non-organic cage-free layer flocks were roughly equal, with both increasing by a little over 1 million hens in this two-year period.

The sale of other (non-organic) eggs is expected to increase more rapidly than organic eggs sales during the next few years.

Between March and September 2015, the rate of growth of the organic and non-organic layer flocks increased. The size of the U.S. organic layer flock increased by 19 percent in this six-month period, while at the same time the non-organic or “other cage-free” layer flocks increased by 27 percent.

Egg producers announce expansion

Several announcements of new farm projects for housing cage-free laying hens by major U.S. egg producers have been made in the past year. Hickman Family Farms followed up on McDonald’s cage-free purchase pledge with the announcement that it will add capacity to house 2 million cage-free layers at exiting Arizona locations.

“Cage free is just the next logical step in providing eggs to our markets and comfort for our hens,” CEO Glenn Hickman said. “Our customers are moving to cage-free faster than the regulatory environment is requiring it, so we want to ensure abundant supplies. It’s the future of our industry and our business.” Based on published reports, Hickman cage-free houses will use aviary systems.

On October 21, 2015, a ribbon-cutting ceremony marked the start of production at Red River Valley Egg Farm located near Bogota, Texas. This cage-free egg farm is a joint venture between Rose Acre Farms and Cal-Maine Foods, the two largest egg producers in the U.S.

The farm’s plan calls for an initial capacity of 1.8 million cage-free layers and the site is permitted for up to 3 million. The layers will be housed in convertible modules designed by Rose Acre Farms.

On October 13, 2015, Rembrandt Foods, the third-largest egg producer in the U.S. and one of the largest egg products suppliers, announced that all of its future farm projects would be cage free. The company had previously announced that it would construct a 7 million-layer facility which would come online in 2017.

Jonathon Spurway, vice present of marketing, Rembrandt Foods, said that the farm on the drawing board will now be cage free, but that it won’t house 7 million hens.

"Any further investments will be aligned to cage-free as our standard,” Spurway said. “The company will have multiple large-scale investments come online.”

Spurway said Rembrandt doesn’t have plans to convert its houses with cages to cage free at this time.

“The industry isn’t going to switch to entirely cage free in the next 10 years,” he said. “Even foodservice outlets like McDonald’s that have made announcements have transitions over a number of years. We are moving quicker than I expected, but I am excited because it offers an opportunity.”

“The consumer is driving the behavior that, ‘I want cage-free eggs at a minimum.’ There is a segment of the population, and it is a large segment, that are willing to pay for cage free or whatever might drive them,” he added.

Forecast for more cage-free layers

The USDA doesn’t publish a forecast for the future size of the cage-free layer flock in the U.S., but industry sources suggest that the rapid growth in the number of cage-free layers seen in 2015 will continue into 2016. Sales of housing systems to U.S. egg producers have seen dramatic shifts in the past 10 years. A market that was dominated by sale of conventional cages saw a shift first to enriched/enrichable cages and now to cage-free systems.

Increasing demand for cage-free eggs in the U.S. has shifted investment in pullet and layer housing to cage-free systems. | Photo courtesy of Big Dutchman

Sources report that, for the first time in decades, the sales of cage-free housing systems in the U.S. in 2015, in terms of number of hens that can be housed, exceeded spaces sold for cage housing. This is expected to continue as sales of even “enrichable” cages fall to very low levels.

If all of the cage-free systems that are expected to be installed by the end of 2016 were fully stocked, the U.S. would have about 19 million more cage-free layers then it had in September 2015. Because it can take a year or more to fully stock a large layer complex, these new projects will not all be fully housed by the end of 2016.

Other factors to consider

The U.S. table egg and egg products markets have traditionally been white egg and white bird markets. Cage-free customers in the U.S. have tended to prefer brown eggs, but as cage-free becomes more mainstream, expect a shift to white eggs, particularly for egg products.

All cage-free systems are not alike in how they allow the three-dimensional space inside a house to be utilized for housing hens. “Combi” or “convertible” systems will compete with aviary systems for share in the non-organic cage-free market. More traditional floor systems will likely continue to dominate the organic cage-free market, because they are more suitable for providing hens the required outdoor access.

Read more:

Legislative, market uncertainty will force egg producers to adapt