Oil is dear, and grains are scarce; but now add poultry fat to the list of commodities that buyers are bidding up in price. The same market forces driving up the energy and feed costs for U.S. poultry processors are boosting demand for poultry fat as a low-cost alternative to soybean oil in the manufacture of biodiesel fuel. Today, in the southeastern United States, there is hardly a drop of low-free-fatty-acid poultry fat on the market that’s not being bid for by biodiesel producers. Questions now facing poultry companies: Is this an opportunity or threat? How can the opportunities be exploited?

“Most major poultry processors and rendering companies are selling poultry fat to the biodiesel industry today,” said Eric M. Bowen, president and CEO of Tellurian Biodiesel, Inc. “This includes major renderers in the Southeast like American Proteins and Valley Proteins, and major poultry processors, including Fieldale Farms, Case Farms, Pilgrim’s Pride and Tyson Foods. Everyone is selling some portion of their poultry fat, either directly or indirectly, into the biodiesel industry.”

Premiums for low-FFA fat

Currently, biodiesel producers are not able to use higher FFA (5 percent or more) poultry fat due to technical limitations in their processes, though those issues may one day be resolved. Meanwhile, low-FFA poultry fat is scarce and commands a premium.

“Poultry fat low in free fatty acids is being bought by the biodiesel industry at a premium,” Bowen told attendees at the Poultry Processor Workshop. “The biodiesel companies are willing to pay a higher price than feed customers because we are making a high-value renewable fuel and thus can afford to pay more than buyers in the feed industry.”

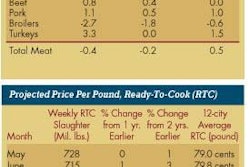

Rendered poultry fat (sub 2 percent FFA) purchased from a renderer in the southeastern United States in May was in the high 30-cent or low 40-cent range per pound delivered. Prices had risen by about 10 cents a pound over the December-May period, according to Bowen.

Market disruptions

As recently as two years ago, 90 percent of the biodiesel made in the USA came from soybean oil, but the run-up in soybean prices has changed this. Then, soybean oil was in the low 20-cent-per-pound range. In the first half of 2008, soybean oil traded as high as 75 cents a pound and more recently hovered in the low-60s. Since feedstock comprises between 70 percent and 90 percent of the cost of a finished gallon of biodiesel, producers are scouring the market for lower-cost alternatives. Of the four viable alternatives – used cooking oil (yellow grease); beef tallow; choice white grease; and poultry fat – poultry fat is the most attractive. It tends to have the fewest impurities and the lowest gel point, or pour point, which is important for transportation fuel.

“In order to redirect that poultry fat towards the biodiesel industry and away from its current uses, we’re willing to pay some premium to get that product going our direction. So, higher prices for fat should mean better margins for poultry producers,” Bowen said.

Opportunity or threat?

Before the biodiesel industry began buying significant volumes of poultry fat, which is a 24-month phenomenon, it had other uses, including as an ingredient in poultry feed and petfood. To some extent, this is disrupting established market patterns.

“Is biodiesel’s interest in poultry fat an opportunity or a threat? The answer is that it is a bit of both. But properly worked through it should be a big opportunity,” Bowen said.

Today, poultry processors are buying back from renderers only the portion of their poultry fat needed as a feed ingredient. But Bowen says poultry processors should consider buying back an additional portion of their rendered fat to go into the production of biodiesel to fuel their truck fleets.

“Is there a way to change your feed mix so as to use less poultry fat in feeding chickens so more would be available for a biodiesel producer to recycle it back for fuel in your truck fleet?” he asked listeners. That’s exactly what Fieldale Farms is doing, he said. (See Fieldale Farms in closed-loop sustainable process.)

“This is really an exciting time for the biodiesel industry,” Bowen said. “It is seeing enormous growth. The last couple of years we’ve experienced 200 percent and 300 percent growth. That’s probably going to fall back a little this year because of the substantial increase in feedstock prices. The biodiesel industry is transitioning from the use of higher-cost soybean oil to lower-cost recycled cooking oil and animal fats. The industry last year produced around 450 million gallons of biodiesel and will produce at least 1 billion gallons by 2012 just by federal mandate. It will probably exceed that level. You are going to see companies knocking on your door interested in poultry fat. This is a good opportunity for your industry.”

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)