Over 276.5 million metric tons of meat were produced around the world last year, says the Food and Agriculture Organization (FAO) of the United Nations. Pork accounted for about 107.5 million tons of that total. Out of an all-meat global supply that averaged 40kg per person/year, therefore, pork was the largest single component at more than 15.5kg.

Pigmeat production worldwide evidently has remained in growth mode. See from our chart (Figure 1) how output rose by 14.6% in the period 1990-1995 and by 12.5% in 1995-2000, before recording a further increase of 19.2% between 2000 and 2006. By FAO's own estimates the one-year rate of growth from 2005 to 2006 was 3.3%. The agency forecasts another 3.1% rise for 2007, equivalent to about 3.3 million tons, taking the world total to a new high of 110.7 million tons.

Figure 2 indicates that the expansion over the past 5 years or more has involved one region more than any other: Asia-Pacific. The Asian share of global pigmeat production climbs steadily year by year. In the year 2000 it was already beyond 50%. Last year, our calculations put it at over 58%. Most of the gain came at the expense of the combined region of Europe + Russia, down from 27% to 24% in this time. North-central America stays steady at around 12% and Latin America at 5%, with Africa yet to account for 1% of all output.

However, the analysis is distorted by China's huge annual production. China was already supplying 46% of the world's pork in 2000-2003. After 2004 its share rose even more, to 47-48%, and in 2006 it was almost at 49%. The amount produced in other Asian countries then emerges in a different light. Asia-Pacific's contribution without China was approximately 8% of world production in 2000-2001, up to 9-10% in 2002-2004 and in the area of 9% in 2005-2006.

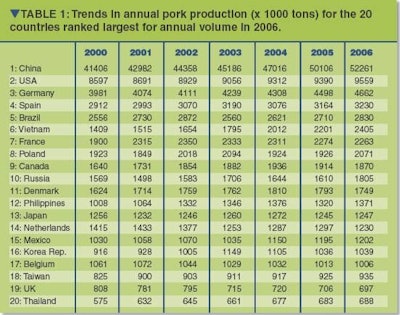

Even so, the listing in Table 1 reveals that other Asian contenders are moving up through the ranks of the Top 20 countries for quantity of pigmeat produced per year. Our analysis published in mid-2006 had put Vietnam in 7th place overall. Now it has risen to claim 6th spot. Some observers believe that the Vietnamese pig sector, with strong encouragement from its government, will soon rival Brazil's for annual output and for export volumes.

The other names from Asia on the Top 20 list, the Philippines and Thailand, have grown again in yearly production size without yet being able to improve their position in the rankings. But the changeover to commercial scale from a still significant backyard segment in the Philippines could mean little overall growth for that country in the short term, while Thailand's producers could ease back on sow numbers temporarily in response to the international increase in the cost of feed grains.

European countries Denmark, the Netherlands and Belgium all have slipped down the list this year, reflecting the relative standstill that was seen across most of western Europe's industries in 2006. In fact, there was little evidence of a marked expansion among the big players also in North America and Latin America. Evidently last year was a time of consolidation as producer returns remained positive, but the threat had already started to loom of lower prices meeting higher costs.

FAO analysts have acknowledged that the recent surges in feed prices look set to reduce the growth in global pork production, while at the same time observing a favourable outlook especially for Brazil (if its pork exports are allowed to resume), Vietnam and Chile. In China, they added, the price strength of feed ingredients has not yet stopped the expansion of the sector in response to ever-higher domestic demand, although it can be seen meanwhile that Chinese pig production is becoming more concentrated in the areas of the country producing feed grains.

The one country not mentioned in their analysis is the place that has caught most European attention recently. Russia has sucked in genetics, equipment and supporting technology for a range of projects to enhance both the volume and the quality of the pork produced. A common view is that this export trade may be short-term, but the resulting boost to production system should carry Russian output upwards at a rapid rate over the rest of the decade. Up to 10th place on our latest list from 11th last year, Russia has the potential to reach at least Number 8 before the decade is over. PIGI