Most analysts agree that while the global economic recession starting in 2008 has had the effect of depressing the market for all meats, the poultry meat sector appears to have been affected less severely than those of other animal proteins. There are even claims that chicken has benefitted from a switch in consumer buying habits away from the purchase of more expensive meats.

Those marketing meat in the developed-economy regions such as North America and Europe have reported finding sales increases for smaller cuts and cheaper products at the expense of premium items.

Canada provides an example. The organization Turkey Farmers of Canada (TFC) has referred to a Statistics Canada report showing total Canadian per-capita meat consumption declining from 88 kilograms (kg) in 2008 to 87.4 kg in 2009, of which poultry meat represented 37.7 kg. The timing of this decrease was recognized as being linked to the recession that caused many consumers to cut back on food expenditures. Turkey meat consumption was also affected, down from 4.5 kg to 4.4 kg. However, a major part of the reduction was found to be due to a lower consumption of further processed items rather than of whole birds or fresh cuts.

The further processed category mainly involves breast meat, according to TFC. As boneless, skinless breast meat accounts for approximately 25% of the carcass weight of a turkey, a 1-kg drop in breast-meat sales is equivalent to a cutback in production of 4 kg live weight. In particular the sales drop has hit the demand for turkeys weighing more than 9 kg, since most of these enter the further processing stream. In Canada, the use of turkeys over 9 kg declined by 7.8 million kilograms between 2008 and 2009.

Chicken outperforms other meats

Chart 1 sets out how the U.S. department of agriculture expected production of the main meats to develop in 2010 in major producing countries and regions, as presented by Nan-Dirk Mulder of Rabobank to the 2010 Alltech international symposium. The poultry industry was expected to outperform those of pork and beef, he commented, growing by 3% compared with a 1.6% annual increase for pork and a 0.7% drop for beef as the global meat market recovered from recession.

The imponderables continue to be feed costs and the volatility of exchange rates. A recent analysis for the European Commission pointed out that approximately one-third of all grain harvested globally is used in feed for production animals. Its price is being influenced not only by climatic conditions and their effects on harvests, but also by the growing linkage between the prices of commodities such as grains and of oil. Additionally, producers must contend with rising costs for their energy inputs and for water.

As 2010 started, the global market seemed to be settling back to historically normal levels for price after the record peaks reached in 2008/09 (see Chart 2, from data compiled by Bloomberg). But the outlook for feed costs became unsettled again during the year when inclement weather reduced crop sizes in several of the largest producing countries.

Changes in industry structure

A more positive aspect was that various reports spoke of a surging demand for livestock products. They also explained that major changes were occurring in the structure of livestock and poultry production around the world. Expansion by the largest players and their increasing degree of vertical integration had widened the gap between them and the rest of the industry in their operating area.

Even so, the poultry business in 2010 remains relatively fragmented. In a few exceptions such as the USA and Thailand the market share held by the three largest production companies is already in the range of 55-60%. In Brazil and Russia the Top-3 poultry producers reportedly share just over one-quarter of the market nationally. However, in the European Union it is still under 15% and in China no more than 6%.

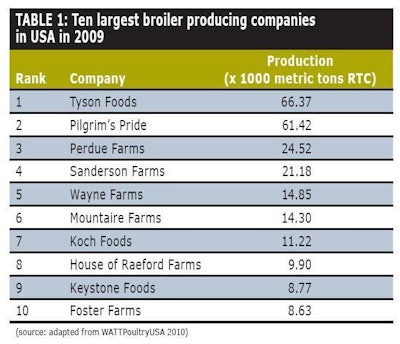

The latest annual survey of American broiler producing/processing companies conducted by WATTPoultryUSA has charted the trend to consolidation in the U.S. industry as in Chart 3. Its data for 2009 revealed that, out of the almost 33,000 metric tons ready-to-cook (RTC) of broiler meat produced per week, the three largest companies accounted for about 46.4% and the Top-10 combined share was nearly 74.7%. Its listing of the 10 largest for production in 2009 is shown in Table 1.