Two charts dominated this year’s Pig International annual world pork market review report. One of them showed, once again, that there was an annual increase in output from many of the largest pig-producing countries in 2010. The other supports the view that more pig meat was produced despite a continuing slide in the number of sows.

When taken together, they support the growing indication from our recent series of reports that a major structural change is taking place in world pig production. Increases in the amount of pork produced globally each year depends on an ever-larger extent on the productivity of herds, rather than on any expansion in the number of animals they have for breeding purposes.

New record

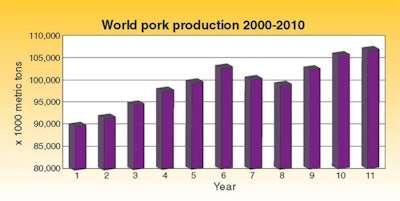

In broad terms, our analysis supports the estimate that the combined efforts of all producers provided about 107.5 million metric tons of pig meat in 2010, compared with around 106.3 million tons in 2009 (see the trend since 2000 as charted in Figure 1) . So last year’s volume does indeed seem to have set another record for the largest amount of any meat that has ever been produced worldwide. It is a considerable achievement and fully supports the proud boast that pork is still the world’s most popular meat.

Turn now to our account of the way the market moved in 2010 in the 20 countries that produce the most pork. As shown in Figure 2, the volumes from China, the United States and Germany put them far ahead of the rest, as usual. But the ranking of countries by size last year does show some differences from 2009. For example, Denmark moved ahead of Italy while the Korean industry suffered a loss of production due to its problems with foot-and-mouth disease.

Note, though, that the Korea Republic was one of only four countries indicated in Figure 2 to have seen a downturn in pig meat tonnage in 2010. That in itself might seem surprising, given the way that the price rise for feed grains has undermined producer margins in recent times. The likely explanation is that in the majority of cases extra feed costs did not hit fully until the start of 2011 after the escalation in prices on world commodity markets in the second half of last year. What is more, poor profitability became a problem in North America some months before a similar situation developed in other parts of the world.

Sow numbers slip

The real contrast to be observed is in the opposite trend denoted in Figure 3, which sets out sow numbers in the 30 largest national breeding herds according to Pig International’s own exclusive database. Whereas Figure 2 had found decreases in only four out of the Top 20 producing countries, Figure 3 demonstrates that the inventory of breeding sows either increased or stayed level in only seven out of the 30 countries it lists. So, in 23 out of 30 places the national industry ended with substantially fewer sows than at the start of the year.

Previous reports in this world market review series have traced declining breeding inventories, but not to the extent now suggested for 2010. Even a few years ago, we were still commenting that sow numbers seemed to be price-proof in the sense that they were being maintained in key countries regardless of the fact of poor pig prices.

It would be too simple to claim that a fundamental change has arrived entirely due to the current economics of the pig business. What we are seeing today is a shift in the structure of the industry towards even greater consolidation and integration. Sow inventories will slip overall during the transition between the exit of backyard producers and the ability of the commercial herds to make up the numbers.

Market confidence

At the same time, the comparative competitiveness of industries is proving to be a factor in producers’ intentions. There is a much greater willingness to invest in the future where confidence in market prospects is high, than where players fear a diminished ability to compete due to regulations such as those relating to the environment and animal welfare.

Structural change can even be government-lead. For size alone, China would always be the one to watch. But its decision in the later part of 2010 to support the projects of larger pig-producing companies nationally has further increased international interest in the Chinese market. These companies have shown again in 2011 that they are looking to become more integrated, with major processors moving to secure supplies by buying into farms and feed-mills. Although their main motivation has been to resolve concerns over food safety and product quality, undoubtedly the timing owes much to the new policy of state support.

China also is expected to supply an example of the environmental imperative for pig production, as its leaders debate proposals to require more of the country’s pigs to be produced in or near areas of grain production, instead of close to the centres of consumption.

In each of the key producing countries, however, a key question is whether there will be enough investment in innovation and techniques, as well as in the establishment or expansion of pork production facilities.

Herds have done extremely well in boosting their productivity as measured by the number of pigs weaned per sow per year and the average weight of meat pigs at slaughter. Their success has allowed global pork output to keep rising even as sow numbers slide. The balance cannot be maintained without significant further investment, however, as it seems probable that the inventory of sows will decrease again in Europe under the pressure of animal welfare laws about housing methods and in Asia due to the structural shift to fewer but larger operators.

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)