Feed manufacturers around the world should take note that industrial aquaculture is on track to overtake capture fishing as the main contributor of global fish supplies for human consumption over the next few years. This important development will bring an obvious boost to future aquafeed demands. Only quite recently the forecasters said that the share of output represented by fish farming would rise from just over 25 percent in 1998 and about 30 percent in 2002 to reach 39 percent in the year 2015. A new report revises this idea significantly. It proposes that the fish farms operating in 2015 will be providing half of all available supplies.

Prepared for a fisheries session at a meeting of the Food and Agriculture Organization of the United Nations (FAO), the report estimates that aquaculture in 2005 produced 48.1 million metric tons out of the 107 million tons of fish consumed worldwide. It illustrates the predicted trend to 2035 by using the chart reproduced in Figure 1.

Meeting increased demand

The FAO document notes how the growth rate in production from aquaculture in recent years has averaged 8.8 percent annually. A total increase of 30 percent was achieved between 1998 and 2002, driving global fish production up to 133 million tons. Almost 101 million tons of that was destined for human consumption. It represented a doubling of the available supply in only three decades. Other sources point out that the average annual uptake per person increased 170 percent between 1962 and 2002. In the year 2020, we may be seeing the average person eat more than 17 kilograms of fish per year.

Specialists from the FAO speculate that the quantities coming from capture fishing in open waters are unable to rise further. Therefore aquaculture must fill the gap in a market where another 37 million metric tons of fish will be needed by 2030, simply to maintain the current level.

It indicates that world aquaculture still has a great potential for further growth, even after growing from an annual output of just one million tons to the current level of almost 50 million tons in the last 50 years. FAO's report calculates the turnover of the business to have reached US$70.3 billion when judged on the price received by producers. Of course, the retail value will have been multiples of that amount.

In addition to fish production, the report continues, aquaculture activities in 2005 produced 14.8 million tons of aquatic plants worth US$7.1 billion. Almost all the aquatic plant production (99.8%) came from the Asia-Pacific region.

It is this region which continues to dominate the supply of aquaculture products. China was the largest single aquaculture producer in 2005, according to the FAO database, achieving 32.4 million tons or 67.3 percent of the global total.

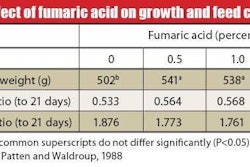

Table 1. Top 20 food fish aquaculture producing countries

The rest of the Asia-Pacific region added another 22.3 percent (see Table 1). Western Europe contributed 2 million tons or 4.2 percent, followed by Latin America/Caribbean at 2.9 percent and North America at 1.3 percent. Middle East/North Africa's share was 1.2 percent while 0.6 percent came from centre/east Europe and 0.2 percent from sub-Saharan Africa (Table 2).

Most aquaculture is produced in the developing countries, pointed out Ichiro Nomura, assistant director-general of the FAO's department for fisheries and aquaculture, in a presentation to the Rome meeting. It contributes significantly to development by providing incomes and employment quite apart from its vital role in global efforts to reduce hunger and malnutrition. What is more, aquaculture can claim today to be the world's fastest-growing sector in food production. Its average annual growth rate since 1970 of almost 9 percent compares with about 2.8 percent for land-based animal production and only 1.2 percent for capture fishing.

Table 2. Aquaculture production [volume and value] in 2005 in different regions of the world

But Mr Nomura also acknowledged the question of whether the sector can grow fast enough to meet the projected increase in demand without causing environmental problems and in the face of constraints that include the depletion of water resources and a limited availability of feeds.

"Climate change could impact negatively on ecosystems and their resources," he added. "A rapid development of aquaculture requires better planning and better management of the sector in order to mitigate the adverse consequences on the environment.

"Given technological advances, well-planned and well-managed aquacultural enterprises can bring about broad benefits to society without adding to environmental degradation. Aquaculture can expand further in a sustainable way."

In the debate over the sustainability of fish supply systems held in Rome under the auspices of the FAO, the main driving force in the intensification of aquaculture worldwide was said to be a decrease in the availability of suitable locations for developing more projects. At the same time, operators in the sector were reckoned to expect increasing competition for water (particularly fresh water for aquaculture farms) and more regulation on waste and abstraction.

But these constraints have created other opportunities, said industry leaders. For example, there is a growing trend towards sea-farming, where many countries are experimenting with off-shore and open-ocean systems.

Environmental impact may even be described now as a challenge from the past, according to other remarks. The sector has considerably reduced its negative image in this regard after years of public pressure. The challenge for many fish producers now is to gain wider access to export markets by improving the quality and safety of their products.