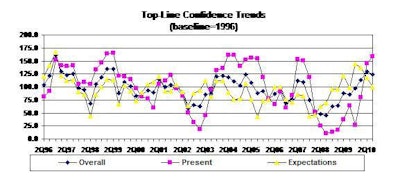

The industry – after sustained periods of low confidence – ascended the mountain last quarter with some summit-like numbers:

- Third-highest Overall Index and Present Situation Index on record

- All indices were above the norm (100) for the first time since early 2005

- Highest overall combined average for the five primary sub-indices

In short, confidence was high, fueled primarily by higher-than-normal prices, restrained production, lower feed costs and declining fuel prices.

But you know what they say – once you’re on the top, the only way to go is down. Fortunately, the poultry industry is headed for a mild and gradual – rather than steep – slope over the next six months. Confidence should remain strong (at normative levels) with improvements in job opportunities and investments (both of which at the right levels could turn around predictions).

Overall Index at 123.4

The Overall Index now stands at 123.4 (1996=100), down slightly from last quarter’s 128.9 (the fifth- and third-highest levels ever recorded, respectively). The Present Situation Index rose to a near record-breaking 158.6 from 146.0. Finally, the Expectations Index fell from 117.5 to 99.9. Although this latter number is “average,” one lingering concern has been a gradual decline in Expectations over the last year.

In general, respondents perceived present opportunities, but recoiled slightly about future conditions and profits. Rising costs (especially grain) and increased production leading to lower prices were the primary reasons for any negative feelings (the bottom line being lower profits). Countervailing ballasts were company expansions (jobs), renewed investments and a general economic recovery.

Broiler and turkey outlooks split

The most dramatic difference this quarter was found across market segments as only 27% of turkey respondents said “it’s likely” they would see profits in at least three of the next five quarters compared to 62% of those in the broiler/chicken industry. This divergent outlook contributed heavily to widely-different expectations. As a result, respondents from the broiler industry remained highly optimistic, equal to last quarter’s record-setting level. Optimism among turkey respondents, however, dropped way off, falling from 152.2 last quarter to 83.9 this quarter.

Summary. Confidence remained high, with even the low numbers only slightly below normative levels. After reaching the proverbial summit, our most likely expectations are for maintenance or decline. Luckily, it looks as if any decay will be gradual and mild rather than a steep cliff. The best news was a positive outlook for jobs and investments as this strong one-two punch could sustain the industry for the near future. The turkey industry bears some additional watching as the forecast was not quite as rosy.