The 2015 edition of WATT Global Media’s annual Nutrition & Feed Survey highlights the differences in the ways each region has been impacted by changes in the world market. After the bountiful harvest of 2014, lower grain costs have brightened the overall outlook of feed producers; however, shifting exchange rates and the challenges of eliminating antibiotic usage pose unique challenges.

Industry outlook mixed

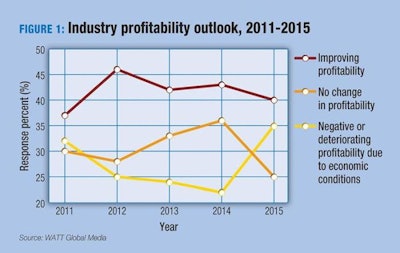

Overall, survey respondents were less optimistic about the business outlook for the year ahead. Although many feel their profitability will improve or stay the same in 2015, exchange rate fluctuations and other economic conditions have prompted a sizable number of respondents to feel the year will take a negative turn (Figure 1). For example, in Brazil and Mexico, currencies have devalued against the U.S. dollar. Though raw materials might be cheaper, the savings don’t translate given the value of the peso or the real -- decreasing the competiveness in these countries.

Despite the potential challenges, these movements may also increase their competitiveness. Many respondents see these changes as a chance for their company to create new export opportunities (Figure 2).

In most regions, such as the United States, exchange rate movements will not impact their purchasing decisions nor will they increase their feed ingredient inventories. However, a large number of respondents (mainly in Latin America) report that they will reduce their ingredient purchasing and forward contracts (Figure 3). It’s also causing them to delay capital investments.

Consumer attitudes shape poultry feed formulations

Consumer perceptions and attitudes have driven a number of changes in poultry feed formulations. While non-GMO and organic rank high in some regions, overwhelmingly, going “antibioitic” or “drug-free” will have the greatest impact on feed operations moving forward (Figure 5).

Not surprisingly, touting the exclusion of unpopular additives is a popular trend. For example, their company’s use of “hormone” and “antibiotic-free” labeling claims ranked high among respondents (Figure 6).

Across the board, respondents report not using or reducing their usage of subtherapeutic and therapeutic antibiotics (Figure 8). Organic acids and enzymes are reported to be effective replacement ingredients (Figure 7).

In addition, respondents also report increasing probiotics and prebiotics in their inclusions due to their effectiveness. Compared to previous years, this signifies an upward trend for these additives.

Commodity prices drive decision making

Despite the current lower grain costs, volatility within the world’s grain markets continues to be very important to the world’s poultry feed producers.

This being said, lower grain costs have prompted many companies to review their approach to ration formulations. Specifically, respondents cite having changed their ingredient sources and increased the nutrient density of their rations (Figure 4). They’ve also begun introducing new or different additives.

Across the board, respondents note ingredient quality and feed safety ranked high as major challenges to their businesses. They note that issues such as mycotoxin contamination, anti-nutritional factors and supply chain risks threaten the performance of their formulations.

The additive usage of survey respondents is visually displayed through this report.