A useful way of analyzing the beef and pork industries is through the study of cycles. For example, the beef industry is now at the point in its cycle, after a long liquidation of heifers, that the number of beef animals is at a low point. The next step is, in all likelihood, the retention of heifers and a slow increase in the production of beef over the next several years. At some point there will be too many beef animals and the liquidation of heifers will begin the cycle all over again. Although beginnings and endings can be tricky, usually the broad idea of a beef cycle is observable.

The beef industry is easier to examine in this fashion than the chicken industry because of the long biological length of the life cycle of that animal. The beef industry is like an ocean liner that takes a long time to turn around. Low returns lead to a slow liquidation which takes months, if not years, to accomplish and is replaced by a slow increase in numbers that also takes years to accomplish.

Chicken industry market cycle

Many have been frustrated when looking for a market cycle in the chicken industry. The short life cycle of the chicken makes it easier for the industry to turn on a dime and accelerate and decelerate production rapidly in response to market conditions. The cycles are therefore more numerous, difficult to determine and frustrating to predict. Nevertheless, there is one number that observers can hang their hat on and that is chicken breeder numbers.

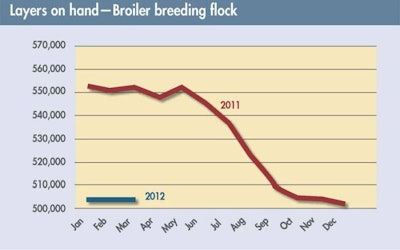

During a period of heavy losses, such as 2011, the chicken industry typically goes through a reduction in the number of breeder hens as part of the process of reducing production to fit the reality of the market. The last several months provided a vivid example of that reduction. Once those breeders are gone there is a natural limit to the ability of the industry to ramp up production once again. Although production can be increased much faster by a chicken industry with a shortage of breeders than the beef industry with a shortage of heifer, there is a lag of several months in the ability to increase production.

Looking forward

Therefore, to the extent that a cycle can be called in the chicken industry, the best evidence of the bottom of the cycle, and, therefore, the potential for the best returns in the cycle, is the number of breeder hens that are currently on the job. At this moment, the breeder flock is the smallest it has been since the late 1990s at 50 million. That would tend to indicate the bottom of the cycle and a profitable year in 2012. In the graph, the dramatic drop in the number of breeders on the job can be appreciated. From 55 million in May 2011, numbers now are down to 50 million.