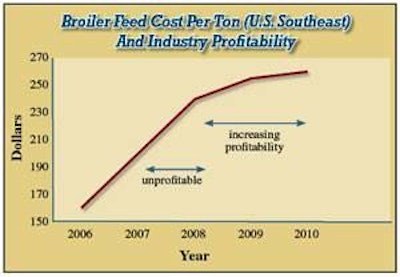

This counterintuitive idea, attributed to Don Tyson, has merit. Obviously the transition from low to high grain prices is painful. Nevertheless, a period of high and stable grain prices can be favorable to the chicken industry because chicken has a better feed conversion than other animals. As a result, competing meats increase in cost more than chicken when grain prices rise. Low and stable grain prices encourage production of other meats and reduce the competitive advantage of chicken.

In 2008 and 2009, this hypothesis will have a test of sorts. So far the scenario is playing out according to expectations. The transition to much higher grain prices is causing pain to the chicken industry and a period of losses. However, continued high grain prices in 2009 and 2010 may result in increasing profitability as the cost, and eventually the price, of competing meats rise to much higher levels.

The industry might get too much of a good thing; grain prices are setting records and could go much higher in the case of a drought. To see what could happen in the worst-case scenario with corn, consider the example of Spring Hard Red wheat prices in the last few months. Spring wheat was an already high $8 per bushel in November of last year and then shot up, briefly, to a high of $25 per bushel. Something similar in corn would be far too much of a good thing.

The causes of this current spike in grain prices are both natural and man-made. The natural part is because of a poor wheat harvest in Australia, Europe and Canada last year. The man-made part is the current mandate of the U.S. government to convert 30 percent of the current U.S. corn crop to ethanol. The combination of U.S. ethanol policy and poor growing conditions sent grain prices to record or near record levels.

So what happens now?

Beef and pork

Beef in the USA has a feed conversion of about 4 to 1; pork is about 3 to 1; and chicken is about 2 to 1. Even with low grain prices, beef and pork are more expensive than chicken. As grain prices rise, the relative difference between chicken and the other meats will increase. However, because of the biology of cattle and hogs, and the non-integrated nature of the business, the transition to higher beef and pork prices takes several months. Production of pork is rising as normal production is combined with the slaughter of sows that will eventually lower production. Beef production will increase in the short run as heifers are slaughtered instead of retained for cow-calf operations. It will take until next year for the dust to settle and for beef and pork prices to rise to levels that are appropriate for current grain prices.

Chicken

Although the short-term trend toward first higher and then lower production of beef and pork appear to be quite predictable, it is a little more difficult to forecast what will happen to chicken production. On the one hand, grain prices are increasing costs by billions of dollars this year, which would discourage production, all else being equal. However, the prospect of eventually much higher prices of beef and pork as well as robust export sales could combine to allow the chicken industry to expand production in the face of higher grain prices and still remain profitable. To understand how this can work think about the major parts of the chicken.

Leg quarters

The price of the back half of the chicken is supported by strong international sales. The major competitor to U.S. leg quarters, Brazilian whole chicken is currently priced much higher than U.S. leg quarters due to the expensive non-GMO corn fed to Brazilian chickens. In addition, the weak U.S. dollar makes U.S. leg quarters a bargain in many countries. As a result, the price of leg quarters in dollars can be expected to remain strong throughout the year.

Breast meat

Deboned chicken breast meat is a rapidly growing meat in the USA, finding its way into every fast- and slow-food restaurant and showing up in hundreds of further processed food products sold in supermarkets. In 2009, consumers will suddenly find surprisingly high prices for products made from beef and pork. They won't stop eating beef and pork, but they will probably eat less of those meats and more chicken. The rapidly rising popularity of deboned breast meat will be enhanced by its increasingly competitive price.

Wings

Chicken wings are wildly popular, and the price of wings will remain high. It is unfortunate that wings are only 10 percent of the chicken.

Putting the prospects for the chicken parts together, growing chicken production by 3 percent this year may well be rational. It may seem irrational before beef and pork prices make their big upward price moves. However, after the other meats increase in price, chicken should be well placed to capture market share profitably.

.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)