Three months since grocery retailing experienced two of the biggest sales weeks at the onset of coronavirus in the U.S., many consumers are growing fatigued with their quarantine cuisine and bored with tried-and-true recipes. Restaurants have reopened, albeit with social distancing measures in place, and reservations and transactions are steadily gaining back lost ground.

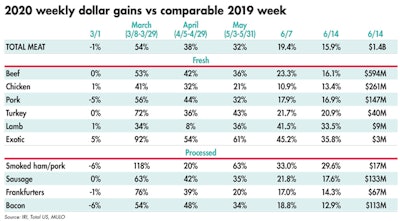

Grocery shopping patterns continued to evolve the second week of June. In most areas, stores had better in-stock position for fresh meat, resolving purchase limitations for some if not all meats. Total meat department sales came in just under $1.4 billion for the week of June 14. Growth percentages for most of the proteins are tapering off compared with mid-March, April and May, but some of the smaller proteins continued to see high gains off their much smaller base.

Prices remain elevated

Prices remained elevated, which resulted in high dollar gains of 15.9% — the 15th week of double-digit gains since the onset of the pandemic — despite of going up against the Father’s Day 2019 sales bump that fell one week earlier than in 2020.

“The surge in total meat and poultry availability in the past few weeks continues to weigh on carcass values and should translate into lower prices at the shelf in coming weeks. Expectations of larger meat supplies and lower prices have made buyers reluctant to build inventory and they continue to buy hand-to-mouth. Beef and pork supplies should remain ample over the summer months and retailers do not want to get burdened with high cost product. We expect buyer interest to strengthen as inventories run low, with especially strong retail sales of grilling items,” said Christine McCracken, Senior Analyst – Animal Protein at Rabobank.

Volume demand also remained above last year’s levels, albeit by just 0.9%, its lowest gain since the first week of March. Shoppers may be dipping into the meat supply they had built up in their freezers and are also highly engaged with seafood, frozen meat and frozen seafood sales, that have all been highly elevated for weeks.

Year-to-date through June 14, meat department dollar sales were up 24.1%, boasting double-digit growth for the months of March, April and May. This reflects an additional $6.5 billion sold versus the same time period in 2019. Year-to-date volume sales through June 14 were up 15.7% over the same period in 2019, reflecting an additional 1.2 billion pounds of meat and poultry sold versus the same time period in 2019.

What’s next?

The meat landscape continues to evolve as supply and demand in foodservice and food retailing try to find their new balance. Meat shortages are getting sorted out and restaurants around the country are seeing consumers start to reengage with dining in, while takeout business remains robust. Grilling season is officially here, giving the meat department many opportunities to help consumers shake up their in-home cooking.

Next week’s report will cover Father’s Day, a traditionally strong meat holiday, but high prices may have affected consumer demand. July 4th is just around the corner and much like Memorial Day, about half of shoppers are expecting to celebrate the Fourth differently, with less travel and smaller celebrations.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.