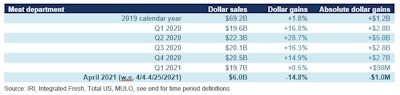

Meat department sales for April 2021 were 22.5% lower than the record-setting figures from the year before, however they were still up compared to 2019 numbers (IRI).

The meat department was an above-average performer since the very start of the pandemic. Meat department sales spiked 35.4% above year ago levels in April 2020, creating a tough year-over-year target. That means, when going up against those sales spikes, meat dropped further behind year-ago levels than other perimeter departments, including produce, deli and bakery.

Meat department sales for April 2021 dropped 22.5% against 2020 levels, however, actual dollars were actually up slightly from March, at $6.0 billion versus $5.9 billion.

210 Analytics and IRI partnered to understand how fresh meat performed relative to their 2020 and 2019 performances.

During the four weeks endings between April 4 and April 25 sales of all food and beverage related items decreased 7.2% and total perishable sales decreased 6.1%. However, total food and beverage sales remained highly elevated from the 2019 baseline, at +12.4%.

Easter week was the strongest of the four April weeks, with $1.7 billion in sales. Regardless, none of the April weeks could match the record 2020 sales. However, each did outperform the levels seen in 2019.

While rebounding slightly from the big March drop, April 2021 sales remain well below year ago levels. However, as seen last month, demand remains elevated compared to the pre-pandemic April 2019 normal, at +15.4% in dollars and 2.3% in pounds.

Fresh meat made up the majority share of sales, at $4.0 billion, which is unchanged from February and March. Processed meat, however, had slightly lower declines at -13.4% versus -15.6% for fresh.

Lamb was the only one staying ahead of April 2020, at +6.9% — even if the earlier Easter timing would have pushed much of the 2021 demand into March. This underscores the strength of everyday lamb demand generated during the pandemic.

When compared to the 2019 pre-pandemic baseline level, all proteins tracked double-digits ahead, with the exception of turkey. The comparison to 2019 shows the true strength of beef, up 21.4% versus two years ago, generating $2.2 billion in sales.

The story for processed meat was very similar. All areas declined in the year-over-year view, unable to go up against the massive 2020 sales spikes. And with the exception of smoked ham, all areas remained well ahead of the 2019 pre-pandemic baseline, with only packaged lunchmeat in single digits. Smoked ham saw much of the 2021 seasonal sales move into March as Easter fell a week earlier than it did in 2019.

In April, TSA checkpoint numbers, dining out, driving and walking statistics, gasoline sales, the re-opening of schools and more are all indicating a higher level of consumer mobility. Increased mobility is also likely to result in a shift from home-centric food spending to greater foodservice engagement but may also drive increased demand for time-saving, convenience focused solutions.

Shoppers increasingly choose to shop for groceries inside the store as COVID-19 concerns abate, according to the April IRI survey among primary grocery shoppers. About 11% of consumers continue to shop for all or some portion online. Additionally, shoppers spent more time in-store. The better COVID-19 outlook appears to be directly related to the return to in-store shopping with 4% less consumers citing they plan to go back to in-store versus some online. Concern about COVID-19 dropped month over month and 66% of shoppers felt relaxed during their last in-store trip, up 13 points since January.

Importantly, consumers who have been vaccinated are more likely to do all shopping in-store and are the ones driving the more relaxed in-store mindset. This points to potentially ongoing shifts back to pre-pandemic behaviors as more people get vaccinated.

View our continuing coverage of the novel coronavirus (COVID-19) pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.

Meat department sales for April 2021 dropped 22.5% against 2020 levels, however, actual dollars were actually up slightly from March, at $6.0 billion versus $5.9 billion.

210 Analytics and IRI partnered to understand how fresh meat performed relative to their 2020 and 2019 performances.

Trips and basket size

April 2020 experienced continued highly elevated sales as most states had issued shelter-in-place mandates — moving the vast majority of meal occasions to at-home. During this time, trips fell far below year-ago levels whereas the average basket ring came in well ahead of the pre-pandemic normal. That means one year later, trips sit well above year ago, though much in line with typical years, while the average basket size dropped well below that of April 2020.During the four weeks endings between April 4 and April 25 sales of all food and beverage related items decreased 7.2% and total perishable sales decreased 6.1%. However, total food and beverage sales remained highly elevated from the 2019 baseline, at +12.4%.

Easter week was the strongest of the four April weeks, with $1.7 billion in sales. Regardless, none of the April weeks could match the record 2020 sales. However, each did outperform the levels seen in 2019.

While rebounding slightly from the big March drop, April 2021 sales remain well below year ago levels. However, as seen last month, demand remains elevated compared to the pre-pandemic April 2019 normal, at +15.4% in dollars and 2.3% in pounds.

Fresh meat made up the majority share of sales, at $4.0 billion, which is unchanged from February and March. Processed meat, however, had slightly lower declines at -13.4% versus -15.6% for fresh.

Fresh meat gains by protein

Going up against massive April 2020 sales, fresh meat dollars fell 15.6% below year ago levels.Lamb was the only one staying ahead of April 2020, at +6.9% — even if the earlier Easter timing would have pushed much of the 2021 demand into March. This underscores the strength of everyday lamb demand generated during the pandemic.

When compared to the 2019 pre-pandemic baseline level, all proteins tracked double-digits ahead, with the exception of turkey. The comparison to 2019 shows the true strength of beef, up 21.4% versus two years ago, generating $2.2 billion in sales.

The story for processed meat was very similar. All areas declined in the year-over-year view, unable to go up against the massive 2020 sales spikes. And with the exception of smoked ham, all areas remained well ahead of the 2019 pre-pandemic baseline, with only packaged lunchmeat in single digits. Smoked ham saw much of the 2021 seasonal sales move into March as Easter fell a week earlier than it did in 2019.

What’s next?

Several indicators of consumer mobility — reflecting how much people are moving around to go to school, work, out to dinner, vacation or visit family and friends, etc.— continue to trend up.In April, TSA checkpoint numbers, dining out, driving and walking statistics, gasoline sales, the re-opening of schools and more are all indicating a higher level of consumer mobility. Increased mobility is also likely to result in a shift from home-centric food spending to greater foodservice engagement but may also drive increased demand for time-saving, convenience focused solutions.

Shoppers increasingly choose to shop for groceries inside the store as COVID-19 concerns abate, according to the April IRI survey among primary grocery shoppers. About 11% of consumers continue to shop for all or some portion online. Additionally, shoppers spent more time in-store. The better COVID-19 outlook appears to be directly related to the return to in-store shopping with 4% less consumers citing they plan to go back to in-store versus some online. Concern about COVID-19 dropped month over month and 66% of shoppers felt relaxed during their last in-store trip, up 13 points since January.

Importantly, consumers who have been vaccinated are more likely to do all shopping in-store and are the ones driving the more relaxed in-store mindset. This points to potentially ongoing shifts back to pre-pandemic behaviors as more people get vaccinated.

View our continuing coverage of the novel coronavirus (COVID-19) pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.