Supply is likely to continue to impact the dollar and volume performance of meat sales in weeks to come.

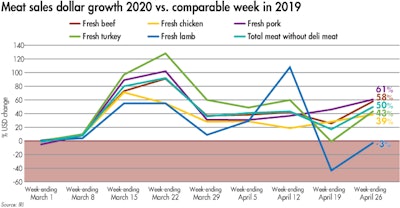

Since March 8, the meat department has been the undisputed sales leader of the perimeter. Year-to-date through April 26, meat department dollar sales were up 21.7%, boosted by double-digit growth for seven weeks running. Year-to-date volume sales through April 26 were up 15.9% over the same period in 2019 as volume has been trailing dollars throughout the pandemic. Additionally, the gap between volume and dollar sales is widening — signaling significant upward pressure on pricing due to tightness in the supply chain.

“Plants are beginning to reopen, but labor has been slow to return and volumes remain sharply below year-ago levels,” said Christine McCracken, Executive Director Food & Agribusiness for Rabobank. “Beef and pork production are both down 35% year-over-year. A handful of chicken and turkey plants closed in the past week, but the impact on total production has been limited. Processors are allocating limited supplies to their bigger customers, leaving smaller, more regional operators with fewer options.”

Consumers feel the impact of plant closures

“Based on the current market changes as well as announced plant closures, sourcing has been challenging to say the least,” said Samer Rahman, Senior Director of Meat and Seafood for Allegiance Retail Services. “With the news reports on plant closures, customers are under the impression meat will not be available in any form. They were alarmed by these reports and started loading up on fresh and frozen meats. An additional obstacle in sourcing meat is the reopening of restaurant businesses in multiple states, resulting in foodservice companies coming into the market to purchase their needs.”

On the impact of the supply chain issues on the consumer, McCracken added, “Consumers will begin to begin to see noticeable shortages of pork, beef and chicken at retail the first full week of May, as prolonged plant closures and labor-related disruption have cleared fresh meat inventories.”

Many consumers commented on limited supply on the Retail Feedback Group Constant Customer Feedback system. “There was limited meat/chicken to choose from. I totally understand this was most likely due to the pandemic.” Another wrote in, “Unfortunately, COVID-19 has the meat department lacking a good selection. You probably need to put limits on the amounts of meat per purchase, since the news media is hyping the possible coming shortage, so that people don't start hoarding, like the toilet paper issue.”

Shoppers are also noticing higher prices and fewer meat features and additional safety measures many retailers are taking. “Prices have gone up on items cause of the virus but there are people who cannot afford items especially meats with a very tight budget,” said a shopper on CCF. Another said, “Just a little frustrated that there were no meats on sale. I was looking for a roast, an item I do not purchase too often, but none were on sale and they are so expensive.”

McCracken agreed that the recent media attention on meat shortages drove another round of panic buying starting the last week of April and going into May.

“We are already seeing stronger foodservice demand for meat as quarantine measures are lifted and restaurants reopen. The combination of tight supplies and renewed foodservice interest drove beef prices to record highs, up 35% week-over-week,” said McCracken.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.