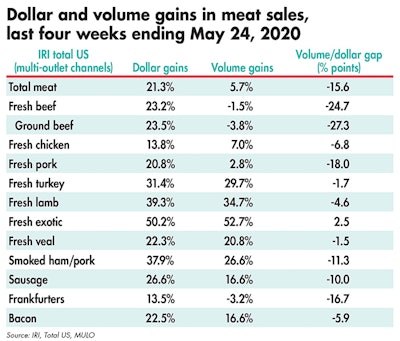

The gap between volume and dollar sales for the meat department reached another high since the onset of coronavirus during the week ending June 7, at 17.5 percentage points. The longer, four-week look ending June 7 showed double-digit volume/dollar gaps for fresh beef and pork, that in turn caused a double-digit volume/dollar gap for total meat.

In fact, volume gains in the four-week look for beef, including ground beef, turned negative for the first time since the onset of coronavirus in the U.S. The volume/dollar gap for chicken, turkey and lamb narrowed compared with prior week reports. For exotic meat, volume gains actually outpaced dollar gains over the four week look.

Total meat volume increased over the first week of June due to gains for chicken and several of the smaller proteins, including turkey, lamb and exotic meats. Just like seen in the four-week view, the gap in volume versus dollar sales was driven by beef and pork. Beef volume sales gains have been negative for three weeks straight and deteriorated from -4.9% during the last week of May to -7.1% the first week of June. Volume sales for pork recovered from a loss the week prior to a small gain during the week of June 7.

Supply and demand swings in recent weeks have made demand forecasting extremely difficult, particularly as restaurants are coming back online and consumer uptake for dining out is unclear.

Market starts to settle

The first week of June marks three full months of coronavirus-related shopping patterns. Following a spike in trips and spending to unprecedented levels in mid-March, the market settled into a period of fewer trips but bigger baskets. The well-publicized meat supply shortages in May drove a rebound in trips for meat whereas purchase limitations and/or limited availability along with high prices started to pressure volume sales.

For our first look at June, supply chain issues continued with prices highly elevated over this time last year. Yet, demand remained above last year’s levels in both dollars and volume, even as restaurants around the country started seeing improvements in reservations, transactions and continued record levels of takeout business.

At retail, purchase limits started to resolve, though geographic differences were significant. During the first week of June, dollar sales grew 19.4% versus year ago and volume grew 1.9%, its lowest gain since the first week of March. Shoppers may be using their freezer stash as back up and are also highly engaged with seafood, frozen meat and frozen seafood sales, that have all been highly elevated for weeks.

Year-to-date through June 7, meat department dollar sales were up 24.2%, boasting double-digit growth for the months of March, April and May. This reflects an additional $6.2 billion sold versus the same time period in 2019. Year-to-date volume sales through June 7 were up 16.1% over the same period in 2019, reflecting an additional 1.2 billion pounds of meat and poultry sold versus the same time period in 2019.

What’s next?

The meat demand landscape continues to evolve as restaurants around the country are allowed to reopen, albeit with social distancing measures in place. Additionally, many states will have officially started summer vacation, but fewer consumers are traveling compared with prior years.

Summer get-togethers and holiday celebrations may still look very different, particularly in hard-hit areas. Father’s Day is around the corner, traditionally a strong meat holiday, but high prices may affect consumer demand. Additionally, grocery sales overall may have been affected by shortened hours due to local curfews, particularly in urban areas.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.