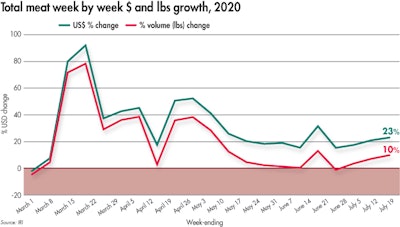

Over the past two months, everyday demand had been experiencing week to week erosion as consumers started reengaging with foodservice. However, the rising number of cases of COVID-19 around the country prompted many states to roll back at least some of the previously relaxed social distancing measures, including restaurant capacity and dine-in mandates. This reversal along with rising consumer concern over COVID-19 is shifting dollars back from foodservice to food retail once more.

For the week of July 19, elevated everyday demand resulted in a 23.4% increase in dollar sales versus year ago for the meat department. This is two percentage points higher than the prior week and the highest gain since late May. This also became the 18th week of double-digit gains since the onset of the pandemic.

While higher prices drove much of this gain, volume gains hit double digits for the first time since the week of June 21, Father’s Day week, at +10.3%. Unit sales continue to wow as well, with 19.6 million more transactions compared with same week year ago and 820 million more transactions since the pandemic began. Pre-pandemic, total meat dept units were down versus year ago. This points to more, but smaller, packages sold.

So far during the pandemic, starting March 15 through July 19, dollar sales are up 35.3% and volume sales have increased 21.9% versus the same period last year. This translates into an additional $7.7 billion in meat department sales during the pandemic, which includes an additional $3.5 billion for beef, $1.1 billion for chicken and $814 million for pork.

The overall 23.4% meat department gain was fueled by double-digit gains for all proteins, including chicken that improved dollar gains from 8.8% the week of July 12 to 14.2% the week of July 19. Lamb and beef had the highest percentage growth, at +40.5% and +30.4%. Beef easily had the highest absolute dollar gains (+$135 million), followed by chicken (+$31 million) and pork (+$20 million).

Dollar share

Throughout the pandemic, the above average levels of inflation for beef and pork helped boost their dollar share relative to total meat department sales. Beef’s share during the week of July 19 is 3.5 points higher than in early March. But both beef and pork also increased their volume share. Beef increased by about 1.5 points and pork by 1.2 percentage points.

Chicken’s share, on the other hand, declined in both dollars and volume. Whereas in early March, chicken had the highest share in pounds, its share during the third week of July is equal to that of beef, at 38.6%. Despite robust gains throughout the pandemic for both lamb and exotic meats, which includes bison, their share of dollars did not change. Exotic meats, however, did see a small uptick in volume share to 0.3%.

Price

IRI’s insights on the average retail price per volume show double-digit increases when comparing prices during the week of July 19 to the same week in 2019, at +11.8%. Inflation is driven by beef and pork prices, though these did moderate versus the prior week. Only lamb prices increased between July 12 and July 19, 2020.

“Despite the drop in production, chicken prices moved lower again — down 7% from last week — as ongoing weak exports continues to erode dark meat values. The slowdown in exports has left sizable inventories of thighs and drums for U.S. markets to clear. Good foodservice sales and improving promotional activity at retail are helping support boneless breast, wing and tender values, but improvements have been unable to offset historically low dark meat values. Wing demand remains robust, with steady demand at foodservice moving good volumes,” said Christine McCracken, Executive Director Food & Agribusiness for Rabobank.

View our continuing coverage of the coronavirus/COVID-19 pandemic.

Like what you just read? Sign up now for free to receive the Poultry Future Newsletter.